Bitcoin (BTC) has arised as a revolutionary force in the financial world, basically modifying how organizations and people regard money, financial investment, and value. Launched in January 2009 by a specific or team making use of the pseudonym Satoshi Nakamoto, Bitcoin was pictured as a decentralized money that operates without the demand for a central authority or financial institution.

In comparison to fiat money, which can be published in unlimited amounts, Bitcoin has a capped supply of 21 million coins, making it a deflationary possession. Bitcoin has given an escape path for many, effectively positioning itself as "digital gold" in the financial investment landscape. The association between Bitcoin and gold solidifies its picture as a possession that people can transform to throughout unsure economic times, aiding sustain its worth and fostering over the lengthy term.

Bitcoin's growing acceptance as a legit kind of payment has also played a vital function in its rise. For many years, an enhancing number of sellers, businesses, and even some governments have actually started to accept Bitcoin as a means of settlement for items and solutions. Companies like Tesla, AT&T, and Microsoft have actually included Bitcoin right into their settlement systems, permitting customers to transact using this digital currency. This mainstream integration helps strengthen Bitcoin's credibility as a reputable money and enhances its use in everyday transactions, eventually sustaining need for BTC and resulting in a rise in its price. In addition, different fintech companies and on-line systems have actually arised to facilitate copyright trading, supplying straightforward interfaces for purchasing, marketing, and holding Bitcoin. As accessibility to Bitcoin improves, so does the number of individuals engaging with it, contributing to a robust environment bordering the copyright.

With the transaction rates and fees of traditional networks being a barrier to widespread fostering, the Lightning Network guarantees to improve Bitcoin's functionality for everyday transactions, making it a much more functional choice for customers and enhancing its beauty. As technical remedies continue to progress, Bitcoin will likely become an also much more accessible and reliable currency, additional solidifying its foothold in the global economy.

The Bitcoin area's passionate believers likewise add to the copyright's development. This community comprises a committed team of programmers, investors, fanatics, and miners devoted to advertising Bitcoin's worths of decentralization, personal privacy, and economic sovereignty. This collective effort cultivates development and makes sure that Bitcoin can navigate challenges with time, reverberating with people seeking an alternative to conventional financial systems. Advocacy teams and companies are check here actively functioning to enlighten the public about Bitcoin, improving its understanding and approval. With numerous instructional campaigns and media insurance coverage, even more individuals are familiarizing Bitcoin's possible benefits, bring about increased fostering and passion.

Movie critics say that Bitcoin's cost variations make it unsuitable as a secure medium of exchange, while regulatory authorities share worries regarding its prospective use in cash laundering and tax evasion. The environmental impact of Bitcoin mining, specifically concerning its carbon footprint, has actually prompted discussions about the requirement for even more environmentally friendly techniques within the blockchain community. Solutions such as transitioning to sustainable power resources or using proof-of-stake mechanisms are being BTC discovered to resolve these worries and alleviate Bitcoin's effect on the atmosphere.

As Bitcoin continues to develop, its role in the global financial system will likely evolve. Additionally, the intro of Bitcoin-based economic products, including exchange-traded funds (ETFs) and futures contracts, provides institutional investors new methods for direct exposure, substantially affecting exactly how Bitcoin is seen within the larger financial landscape.

On the regulative front, federal governments worldwide grapple with just how to come close to Bitcoin and copyright guidelines. As Bitcoin occupies a progressively main role in discussions bordering electronic money and fiat options, the governing framework developed will considerably affect Bitcoin's trajectory.

Finally, Bitcoin has observed amazing development since its inception, transforming the way we think of cash, money, and investments. Its decentralized nature, limited supply, and climbing fostering not only place it as an unique different currency but additionally as a sought-after asset class amongst investors. While Bitcoin faces different TON obstacles that require continuous focus, including regulative, environmental, and technological issues, the overall fad factors towards a more integrated and approved place for Bitcoin in the 21st-century economic climate. As technology developments, and as even more people recognize Bitcoin's potential advantages, its use and approval are destined to expand even more. Bitcoin's trip might be full of volatility, however its underlying principles of decentralization and monetary empowerment remain to reverberate with people worldwide, changing exactly how they view worth and money in a significantly digital age. As we look towards the future, it is essential to take into consideration exactly how the developing landscape of Bitcoin can form individual money, investment strategies, and the global financial framework, highlighting the interesting possibilities and challenges that lie in advance in the globe of copyright.

Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Marques Houston Then & Now!

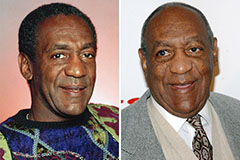

Marques Houston Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!